Overview

When Nutanix succeeds, you succeed—especially when you own a bit of the company, too. Through the Employee Stock Purchase Plan (ESPP), you can invest in your talents and hard work by purchasing common stock at a discount of 15 percent. You participate through convenient after-tax payroll deductions, which makes it easy to save.

Highlights

The ESPP can support your financial goals in a variety of ways:

Company ownership.

The plan enables you to invest in the company so you benefit from the stockholder value that your work helps to create.

Saving made easy.

Through after-tax deductions each pay period, you regularly—and very simply—set aside money to invest in Nutanix common stock.

Contribute more and save more.

You can contribute between 1 and 15 percent of your eligible compensation during each offering period, and you can purchase up to 1,000 shares each purchase period.

Reduce, pause, or stop participation.

You can reduce or pause your contributions (move them to 0 percent) once per purchase period. You can also withdraw at any time. When you withdraw, all contributions will be refunded to you via payroll.

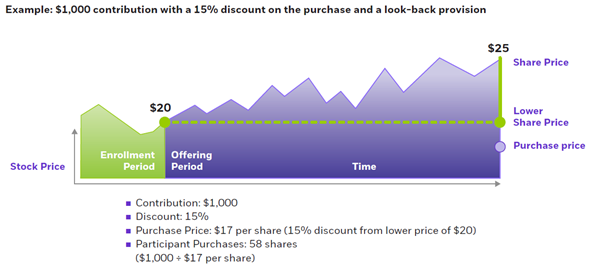

Purchase price

The purchase price for shares will be the lesser of 85 percent of the fair market value on the first trading day of the offering period, or 85 percent of the fair market value on the last day of the applicable purchase period.

Eligibility & Enrollment

You're generally eligible to participate if you’re scheduled to work at least 20 hours per week and more than five months in any calendar year.

E*TRADE enrollment periods open on or around March 1 and September 1 each year. Each offering period generally starts with the first trading day on or after March 20 and September 20, and ends approximately 12 months later (on the first trading day on or after March 20 and September 20 of the following year). Read more about the program on The Spot (the intranet); just search for ESPP.

For more information about the ESPP, visit the E*TRADE website or call 800-838-0908.

Please read the Nutanix, Inc., 2016 Employee Stock Purchase Plan and related documents, which are available on the E*TRADE website and include complete program administration and eligibility details, plan operation Q&As, and tax and ERISA (Employee Retirement Income Security Act) information.

Don’t forget to name a beneficiary!

Designate or update your beneficiary to make sure your account is distributed as you wish. Go to the E*TRADE website and log in to your account. Follow these steps:

- Under “Welcome, [Your Name]”, select “Account Preferences” on the right-hand side (settings button).

- Click “View/Edit” next to “Account Beneficiary.”

- Update as needed, and click “Submit/Save.”